I need to clear up a popular misconception right now.

Everything that goes up must come down. Even New York City real estate.

But Not Everyone Agrees

I once represented a woman whose husband was in deep trouble with the authorities for Medicare fraud (yes, they need real estate agents, too). As part of the settlement they had to sell a Central Park South property and give the proceeds to the government. The apartment sat on the market for months, however, for one reason: They disagreed on the valuation. They shot down offer after offer, no matter what recent sale price “comp” I showed them, no matter what data the buyers might present.

On one particularly frustrating phone call to discuss yet another offer, though, the foundation for our disagreements finally came to light. She cut me off as I tried yet again to make my recommendations. “But Scott,” she said, “when we bought, our friends said that New York City real estate never goes down.”

I paused for quite a bit longer than I expected to. Why was I so stunned? I listened to someone I believed should have been far more savvy. This was a $4 million property after all, which they owned without a mortgage. Even if they amassed their wealth illegally, doing so still requires hard work and creativity, no? I expected at least some level of practicality, rationality, or resignation to the situation. They had one choice, which was to sell, and at the price the market would give them.

That was a few a years ago, but here are a few recent examples that prove my point, just from my own deals:

-

I wrote about this gorgeous property that sold for a million dollar loss on Fifth Avenue and 71st street.

-

This Chelsea property was purchased in 2015 for $3.8 million and the seller took a $1.2mm hit when it closed in 2024.

-

This Upper West Side home bought during the Covid lows sold for a 10% loss, too.

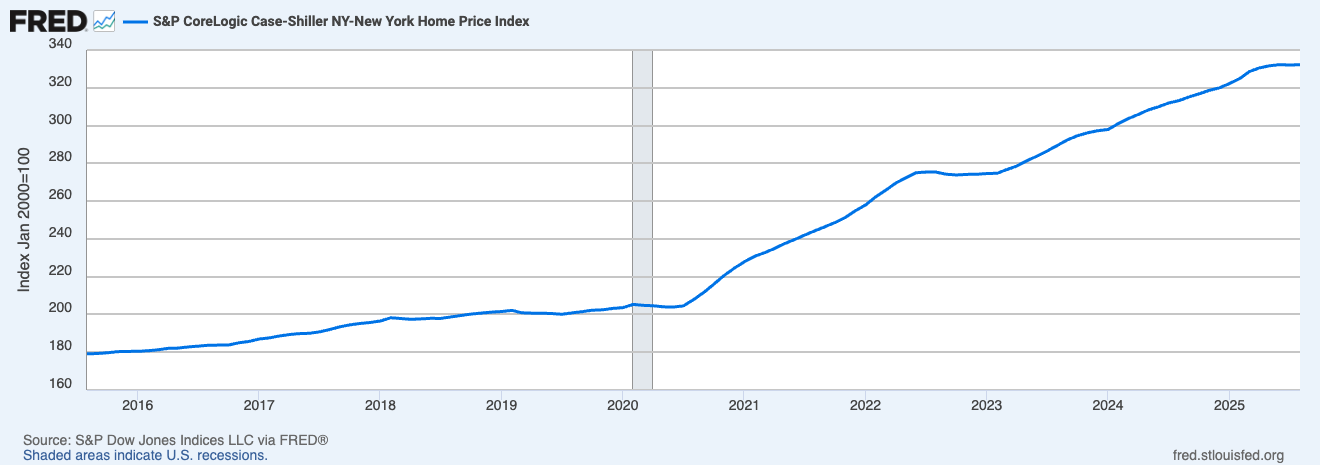

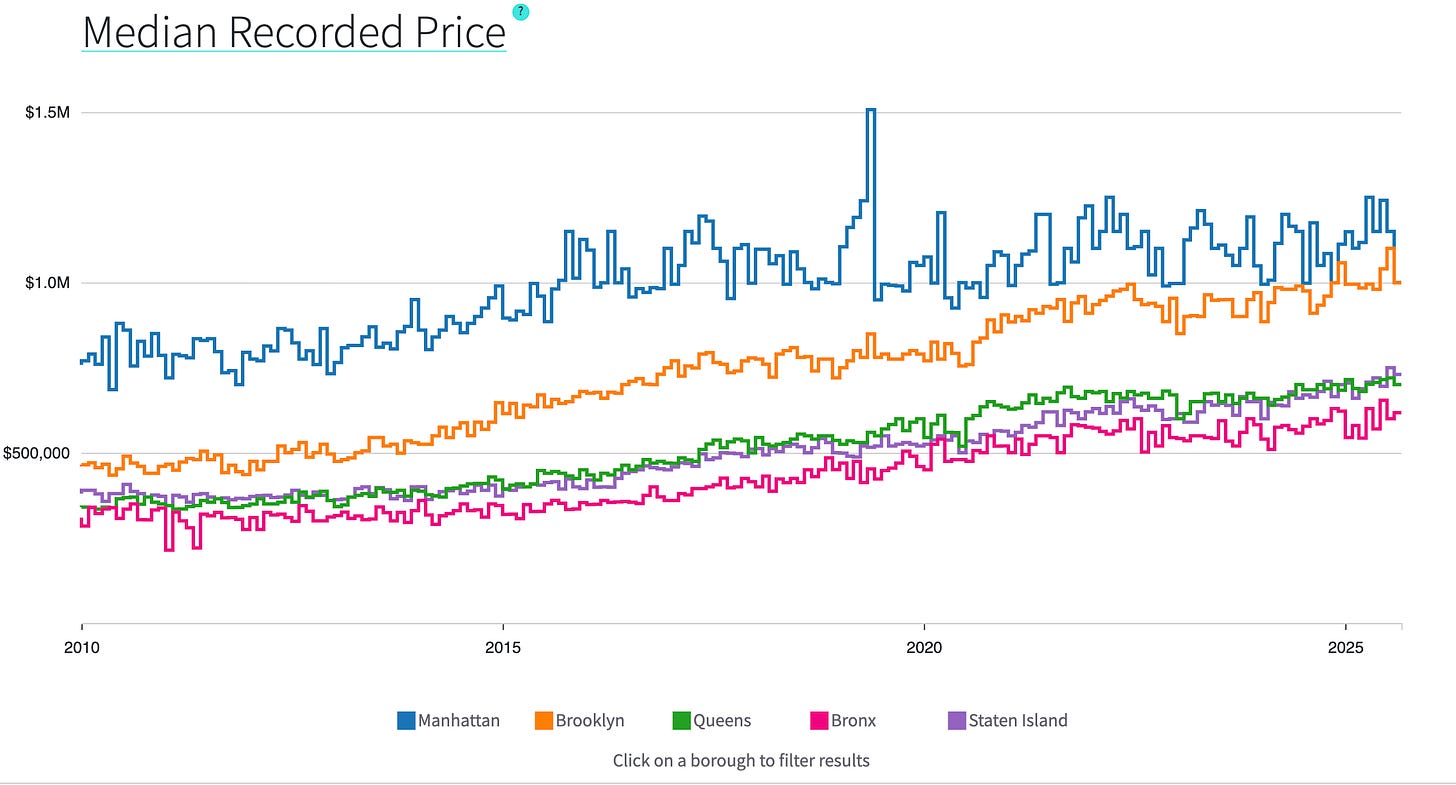

A recent article discussed another shocking data point: fully one-third of all properties selling in the past year in Manhattan sold at a loss. Yet the past decade wasn’t stagnant, as many people might think. It went up significantly even as late as 2017, but then started to lose steam from 2018-2019. Without COVID in 2020 it appeared it would have begun an upward move, but the boom was delayed; from late 2020 until mid-2022 things roared across the country. Only the doubling of interest rates put the brakes on a real estate boom. And while the luxury market in New York City has been surprisingly strong, especially in New Development, we’re only seeing green shoots today in certain pockets and neighborhoods. There’s not one market, but many—and many of them have indeed remained stubbornly slow.

One thing is clear: the market doesn’t have to agree with your timing on the sale of your property. You may be selling into a down market.

Your life changes. You lose your job, or your spouse, or they go to jail. You buy a country house and it becomes your primary residence. You get pregnant. Your kids get into a better school uptown.

You also might just change your mind, or lose it. Believe it or not, I’ve resold more than one apartment just weeks after my buyers closed on their purchases. One seller thought her new apartment had toxic vapors and moved out, much to her husband’s confusion. Another convinced herself that a neighbor’s smoke was getting in, much to her husband’s head shaking.

People also convince themselves that New York is going to turn to dust during a pandemic, or they plan to flee because of one terrible mayor or another. Your timing is not a buyer’s problem. And the market is the market. For any number of reasons, your property may have lost value.

But stepping back, I can also see it from my Central Park South seller’s perspective: that of the confident investor. Maybe she just thought the market was wrong, and would turn.

Maybe she was right. But her confidence didn’t move the market before she finally capitulated, or the government forced her hand. As John Maynard Keynes was purported to have said, “the market can stay irrational longer than you can stay solvent.”

How Deep are Your Pockets?

Sellers in Manhattan are usually not reaching such distress. Many have the capacity to wait it out. For example, I marketed a high floor, 9-room apartment on the East Side a few years ago for a friend. It had 3500 square feet, four bedrooms plus a library on a high floor, with light and quiet and views of the city and the reservoir. We priced it at $7.5 million, which we thought was a realistic price.

For almost a year, I couldn’t give it away. We got some low offers that the seller (rightly) didn’t take. At the same time, another owner with the same layout on a lower floor sold his unit for such a discount that I hoped the co-op board might reject the deal. Alas, they didn’t.

That lower-floor buyer got a great deal. My seller took his unit off the market. Today, I get a call every 1-2 weeks from an agent or a buyer begging me to convince my owner to sell.

Things change. Markets have cycles, some short, and some longer. No asset class is immune to these cycles, even real estate. I’m hearing of softening here and there, from agents in other parts of the country. Colorado, Florida, California, too. It’s happened to New York many times. And it will happen again in the future.

People should know better. It’s not that long ago when we had a recession in 2008-2009, or a dip after Hurricane Sandy, or the pandemic. Yet recently, I heard about a Long Island lawmaker who had the same misconception as my not-so-law-abiding couple referenced above. He, too, convinced himself that surely, New York City real estate never goes down. How could he get elected with a memory that short? Perhaps I’ve answered my own question. Voters don’t seem to have much appreciation for history, either.

Dare to Make a Prediction?

That’s all in the past, of course. What’s going to happen right now? Some buyers are licking their chops, hoping for further discounts after a contentious election. I’m seeing indicators that other buyers don’t care. My evidence? Bidding wars, strong closing prices in neighborhoods across the city, and increased sales volume and average sale prices, too.

Some sellers are seeing their properties fly off the market, and at eye-popping prices. Others are ready to call it quits, with listing agents begging me for an offer.

Where will the market go from here? Up or down? Who will be right? I’m more convinced than ever that it is nearly impossible to time the market. But right now, you’re going to be hard pressed to make a bad buy in Manhattan. Things don’t always go up, but they’ve gone back down for long enough to give me great encouragement. Those who make moves in times of uncertainty—with guidance—stand to make great gains, too.

Get educated on the market. Get confident and prepared. And choose wisely. And check your misconceptions at the door. Luck, as they say, favors the prepared.

Scott Harris is a veteran real estate agent and founder of Magnetic, a boutique brokerage firm in Manhattan with over $2 billion of sales under his belt. He is also the nationally bestselling author of The Pursuit of Home: A Real Estate Guide to Achieving the American Dream, available in stores now. Buy it here or wherever you shop for books.